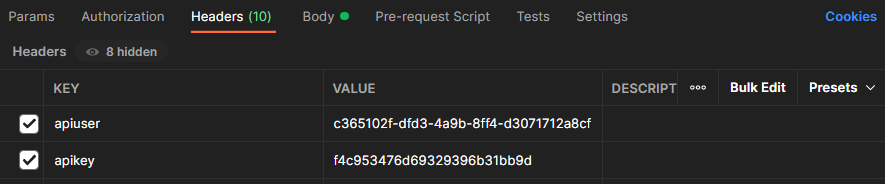

API Credentials

API credentials are used to make requests to all Fapshi

endpoints available to developers. Failing to provide or

providing wrong credentials will therefore lead to errors being

returned in the response of your requests.

The credentials of the testing environment (sandbox) are

available to all Fapshi users (on the dashboard), however, only

verified Fapshi users

have access to the live credentials, after

creating a service.

These credentials (apiuser and apikey) can be obtained on the

Fapshi dashboard

after some prior account verification (See the

Activate your Fapshi account

section).

The credentials should be added to the header of every request

using the parameters apiuser and apikey as

shown below.

Attention!

The apikey of the live environment is given to you once and

should be copied and stored safely. However, it is possible

(and advisible) to generate a new apikey should you suspect

that your current apikey has been compromised. This will

invalidate the previous apikey.

The combination of your apiuser and apikey should be kept

extremely jealously because they essentially serve as a

username and password which are used to authenticate

developers in our system and should

in no case be shared or made public. You

bare full responsibility should your credentials be used in

a way that violates our

Terms & Conditions

or

Privacy Policy.

Base URL

When in live mode, the base URL is same for all endpoints.

However, the sandbox environment has a different base URL.

In both environments, the URL paths are the same, just the base

URL changes.

Live Base URL:

https://live.fapshi.com

Sandbox Base URL:

https://sandbox.fapshi.com

Failed and Successful Requests

If any request made to the Fapshi payment API fails, the

response will have a status code of 4XX (400, 403, 404)

depending on the nature of the error and the body of the

response will have a message parameter containing the reason for

the failure.

However, a successful request will have, in its response, a

status code of 200 and the content of its body will depend on

the nature of the request.

Live Vs Sandbox Environment

The sandbox environment is used to test or better understand the

functioning of the Fapshi payments API. Here, no real money is

involved, however, it behaves in exactly the same way as if the

money used were real. This is to help developers easily

integrate our payments API on their application while still in

development.

The sandbox or test environment works in the same way as the

live environment. However, the credentials of the sandbox

environment won’t work on the live and vice versa. Also, the

base URL of the sandbox environment is different from of the

live. See the Base URL section above.

On the sandbox, if you want to simulate payments with a local

payment method, depending on the phone number chosen, you will

either have a SUCCESSFUL or FAILED transaction status.

Numbers for Successful Transactions:

| MTN |

670000000, 670000002, 650000000 |

| ORANGE |

690000000, 690000002, 656000000 |

Numbers for Failed Transactions:

| MTN |

670000001, 670000003, 650000001 |

| ORANGE |

690000001, 690000003, 656000001 |

If you choose to pay with a number not among one of these, the

transaction status will be decided in a random manner.

For international payment methods, the following card numbers

will simulate SUCCESSFUL and FAILED transactions respectfully.

Details for Successful Transactions:

| Number |

CVC |

Date |

| 5555 5582 6555 4449 |

Any 3 digits |

Any future date |

| 4000 0075 6000 0009 |

Any 3 digits |

Any future date |

| 4000 0048 4000 8001 |

Any 3 digits |

Any future date |

Details for Failed Transactions:

| Number |

CVC |

Date |

| 4000 0000 0000 9987 |

Any 3 digits |

Any future date |

| 4000 0000 0000 0069 |

Any 3 digits |

Any future date |

| 4100 0000 0000 0019 |

Any 3 digits |

Any future date |

Note!

Moving from the test to the live environment will require

you to replace your test keys

with your

live keys and switch the base URL of your

request from the Sandbox Base URL to the

Live Base URL. If done correctly, you are

good go!

Ready to get started?

We have done all necessary to help you quickly setup

and integrate the API on your platform. Check our SDKs

and sample code to get going.

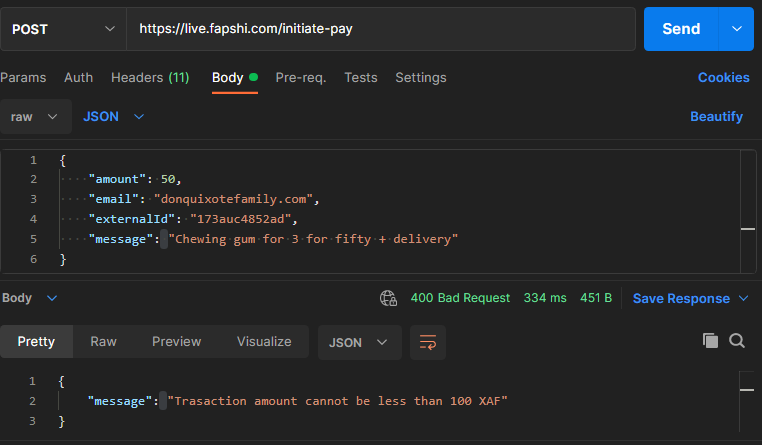

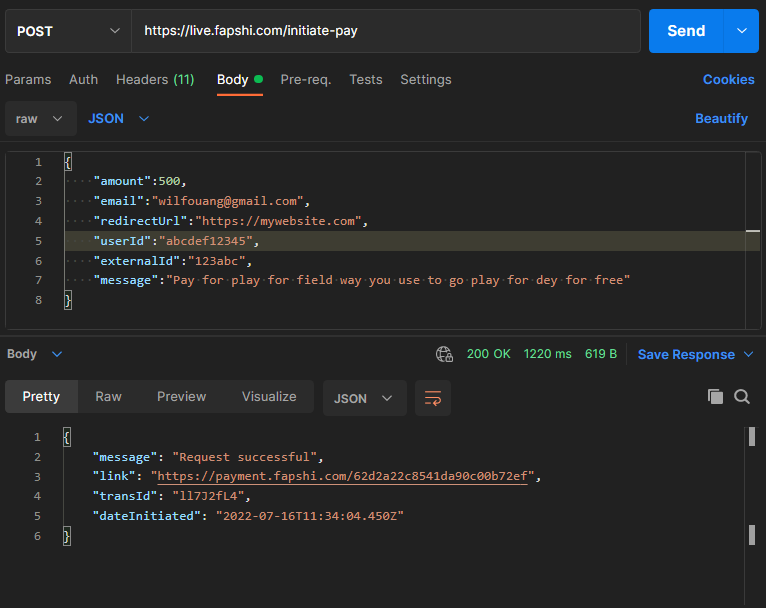

1. Generate a Payment Link

Endpoint: /initiate-pay (POST)

This request is used to generate the link to which a user should

be redirected in order to make a payment.

Parameters:

amount: required | integer >= 100

email: optional | string. If the email is set,

then the user will no longer be required to provide his/her

email during the payment process.

redirectUrl: optional | string. URL to which

your user will be redirected after completing a payment.

userId: optional | string | length between (1, 100) |

characters allowed [a-zA-Z0-9- _]. If the user making the payment is known by your system,

his/her id should be passed in, making it possible to later

query the payment history of this user.

externalId: optional | string | length between (1, 100) |

characters allowed [a-zA-Z0- 9-_]. This can be a transaction id, an order id or anything that

can be used to reconcile this payment transaction to your

application.

message: optional | string. Contains a message

describing the reason for the payment.

cardOnly: optional | boolean. If set to true,

only international payment options will be available on the

generated link. However, international payment options must have

been enabled on the service account whose credentials are used

to perform the request, else the request will fail. Check this

guide on

How to Activate International Payments.

Return:

-

If the request is successful, the response will have a status

code of 200 and its body will contain a

link and a transId variable.

The link is the URL to which the user should be

redirected in order to complete his/her payment.

transId is the id of the payment transaction and can

be used to get the status of the payment, hence, it is

judicious to store this transId on your system.

-

If the request fails, the response will have a status code of

4XX depending on the reason for the failure and a message

describing the reason for the failure.

Note!

A programmatically generated link has a validity period of

24 hours after which it is impossible to

complete a payment using the link.

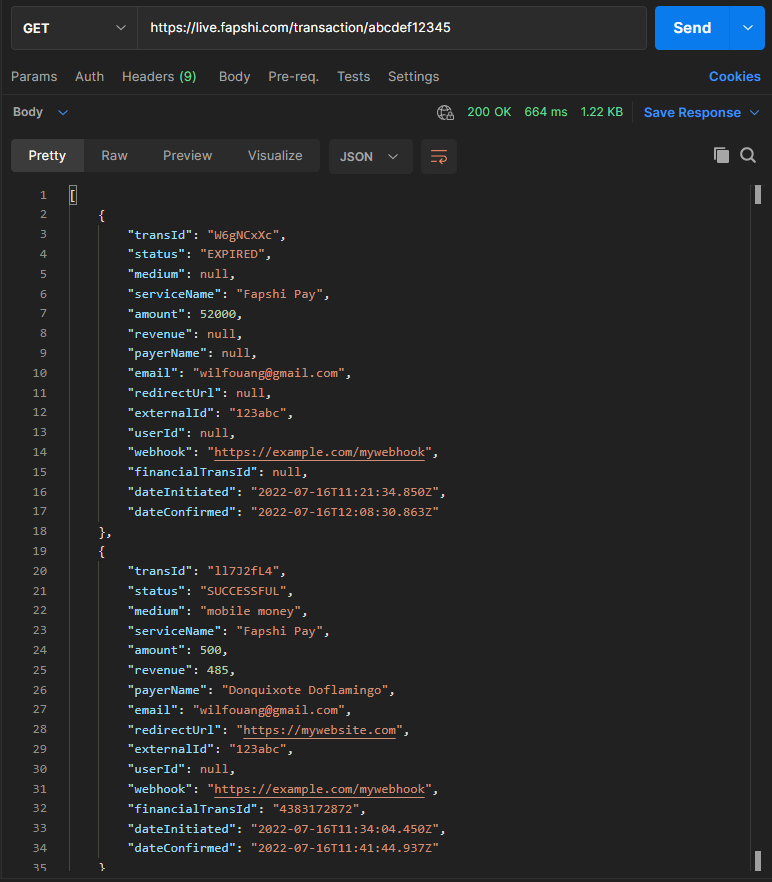

2. Get Payment Transaction Status

Endpoint: /payment-status/:transId (GET)

transId is the Id returned in the response of request

(1) above. The status of a

transaction can be:

CREATED: This means a payment attempt has not

yet been made.

PENDING: This means the user is in the process

of making a payment. Usually, the status of such a transaction

will change to SUCCESSFUL or FAILED immediately the transaction

is completed.

SUCCESSFUL: This means the payment attempt has

been successful.

FAILED: This means the payment attempt failed.

EXPIRED: This means 24 hours have passed since

the payment link was generated and no successful payment attempt

was made in that time interval OR the link got manually expired

like in (3) below to prevent

payment.

Note!

Once the status of a payment is SUCCESSFUL or EXPIRED, no

other payments can be made using its link.

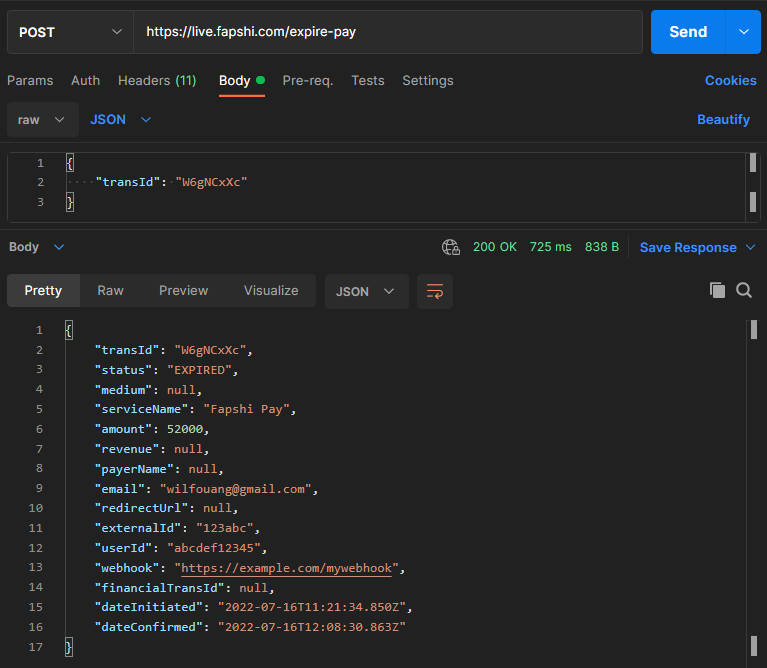

3. Expire a Payment Transaction

Endpoint: /expire-pay (POST)

Expiring a payment transaction will make it impossible for a

payment to be made via the transaction link.

Parameters:

transId: required | string, this is the id returned while

creating the transaction.

Return:

If the request is successful, the body of the response will

contain the details of the payment of the

EXPIRED transaction.

Note!

If a request is made to expire an already expired

transaction, it will return an error with a 400-status code

and a message: "Link already expired.""

4. Get Transactions with the Same User ID

Endpoint: /transaction/:userId (GET)

If any of the payment requests in

(1) above contains a user

Id, then it is possible to get all transactions associated to

this user Id. This request returns an array of objects

containing the information related to the payments associated to

the user Id passed in the URL of this request.

5. Initiate a Direct Payment Request

Endpoint: /direct-pay (POST)

Fapshi offers the possibility to initiate a payment request

directly to a user’s mobile device. However, the developer bares

full responsibility over the user’s payment process i.e., from

building a custom checkout form where user details are collected

to verifying the final payment status of a transaction

(SUCCESSFUL or FAILED).

This request, if successfully initiated, will directly prompt

the user with the phone number specified in the request to

confirm the transaction after which the developer will be

notified with the details of the payment via his/her webhook if

he/she had set one on his/her dashboard or will simply have to

use

(2) above

to get the transaction details.

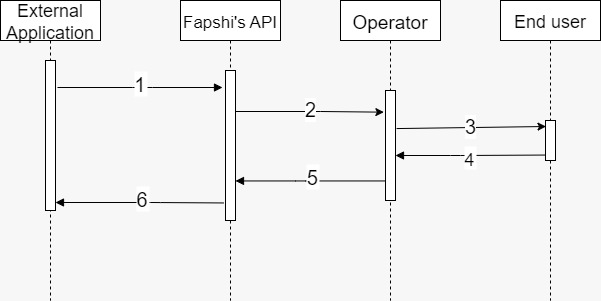

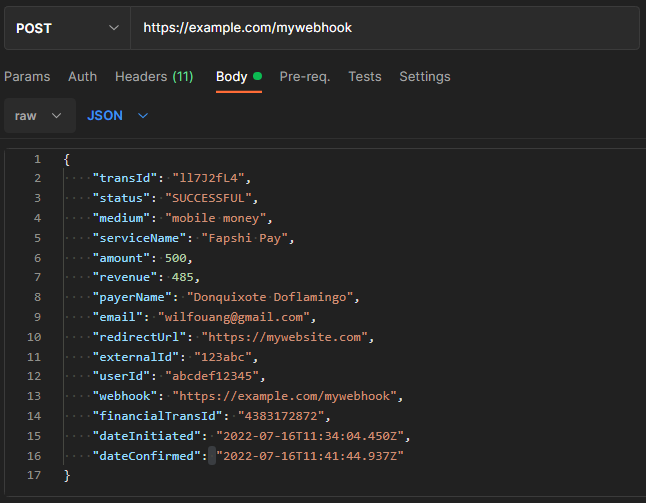

The image below shows the sequence...

1 - An external application with API credentials initiates a

payment request to Fapshi’s API

2 - Request is validated and sent to the appropriate operator

for processing

3 - User is prompted to validate payment by entering his/her PIN

4 - User approves or declines payment

5 - Operator notifies Fapshi with status of payment transaction

6 - Fapshi notifies external application (via the app’s webhook)

with the final status of the transaction

Note!

On live mode, this endpoint is blocked by default.

Contact support

if needed.

Below are the body parameters required to perform a successful

transaction.

Parameters:

amount: required | integer >= 100, amount to be

paid by the user.

phone: required | string, phone number to which

the request will be performed e.g., 67XXXXXXX, 69XXXXXXX,

65XXXXXXX.

medium: optional | string in [“mobile money”, “orange

money”], this parameter can either be “mobile money” for MTN numbers

or “orange money” for Orange numbers. However, if the operator

the user wants to make the transaction with is not known, this

parameter can simply be omitted and Fapshi will automatically

detect and perform the request using the appropriate payment

method.

name: optional | string, name of the user

performing the payment.

email: optional | string, email of the user

performing the payment. If the email is set, a payment

confirmation receipt will be sent to this email.

userId: optional | string | length between (1, 100) |

characters allowed [a-zA-Z0-9-_], if the user making the payment is known by your system, his

id should be passed giving the possibility of later querying the

payment history of this user.

externalId: optional | string | length between (1, 100) |

characters allowed [a-zA-Z0- 9-_], this can be a transaction id, an order id or anything that

can be used to reconcile this payment transaction to your

application.

message: optional | string, contains a message

describing the reason for the payment.

Return:

-

If the request is successful, the response will have a status

code of 200 and its body will contain a

transId variable. This transId is

the id of the payment transaction and can be used to get its

status, hence, it is judicious to store this transId on your

system.

-

If the request fails, the response will have a status code of

4XX depending on the reason for the failure and a message

property describing the reason for the failure.

Note!

Direct payment transactions

cannot and do not get expired.

Consequently, their final state is either

SUCCESSFUL or FAILED.

Attention!

Make sure to take all necessary precautions to avoid the

misusage of this endpoint. Should any complain be made, your

account will be blocked as per our

Terms & Conditions

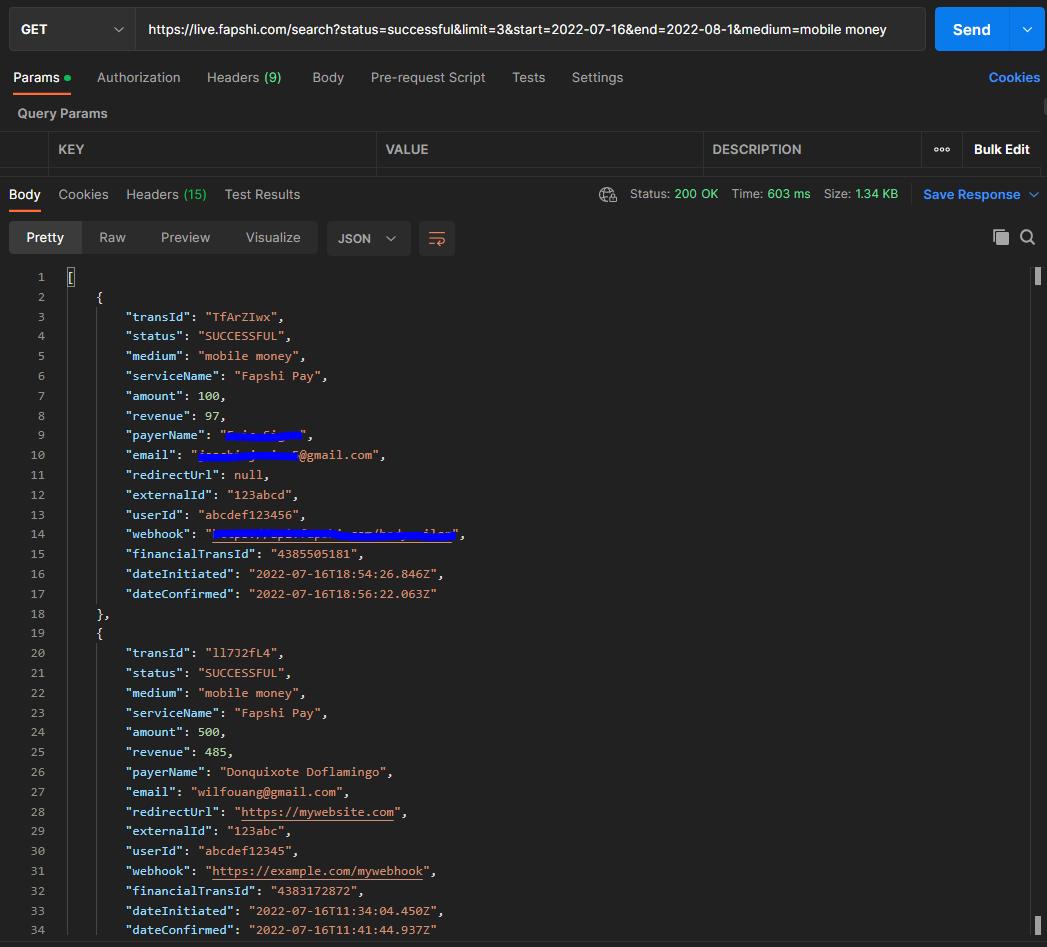

6. Search/Filter Transactions

Endpoint: /search (GET)

With the Fapshi API, it is possible to get the list of

transactions the pass some certain criteria. These criteria are

specified as query parameters in the URL of your request and are

as follows:

status: Returns only transactions matching the

specified status. It can take only the following values;

created, successful, failed and expired.

medium: Returns only transactions matching the

specified medium. It can take the following values; mobile

money, orange money and card.

name: optional | string name of the user

performing the payment.

start: A date of format yyyy-mm-dd. If

specified returns only transactions that were initiated after

the said date.

end: A date of format yyyy-mm-dd. If specified

returns only transactions that were initiated before the said

date.

amt: Stands for amount. If specified, returns

transaction matching this exact amount.

limit: This indicates the maximum number of

transactions that can be returned by a search request. It takes

any integer between 1 and 100 and defaults to 10 if left

unspecified.

sort: This specifies the order in which the

transactions should be return in the response array. It takes as

value; asc or desc (ascending and descending). An ascending

order will mean the oldest transaction in the list will appear

at the top while a descending order will mean the most recent

transaction will appear the top. If left unspecified,

transactions will appear in a descending order.

Note!

If any of the above parameters contains an invalid value, it

will simply be ignored and the request will behave as if it

was not specified in the first place. Also, the transactions

returned in the in response are in descending order of

occurrence if the sort parameter is omitted i.e., the most

recent appear on the top.

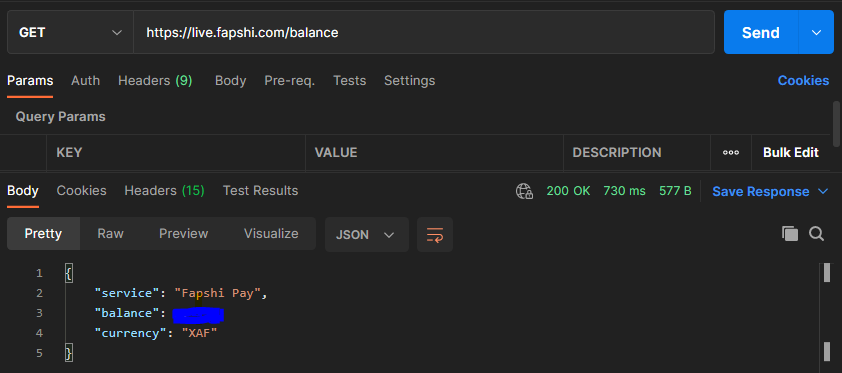

6. Get Service Balance

Endpoint: /balance (GET)

Returns the amount left in the service’s account. Does not

require any parameter.

Note!

In the sandbox environment, this balance is randomly

generated every time the request is made.

Payments (payment-related questions)

Why was I debited?

Fapshi processes payments for multiple merchants. When your

debit alert reads Fapshi Inc, it simply means that the

transaction was made to a business or vendor that uses Fapshi

for collections.

Do I need to pay to

use Fapshi?

You do not need to pay to use Fapshi; all you need do is create

an account (it's free). However, Fapshi offers some services

which will deduct a minute percentage of your revenue when you

use them.

Do I need to have a

Fapshi account for someone to send me money?

No, you do not. Fapshi users can send money to people who do not

have Fapshi accounts through payouts, provided the non-Fapshi

users have an account on one of our supported operators. The

procedure is simple and seamless.

Does Fapshi keep my

money?

Fapshi does not keep its users' money. All account balances, are

kept with our partner operators. They are the ones who have

entities to keep, preserve, and secure your money.

Account

Why must I verify my

account?

Verifying your account permits us to know who you are. With

this, we can better serve you and give you personalized

experiences on Fapshi.

Why do I need to

verify my business?

We need to be sure of who you are and what your business does;

this helps us to propose the best services to you and your

clients. Our partners and regulatory bodies also require that we

know who our clients are.

General (general questions on using Fapshi)

What is Fapshi?

Fapshi is a set of tools that helps you to collect payments

easily. We have prebuilt SDKs to help you integrate our APIs on

your websites, web apps, or mobile apps. Fapshi users can

collect all forms of payment through easy-to-create,

self-managed payment links. You can equally create links for an

invoice or product, and own an easy-to-customize online store.

What do I do if I

forget my password?

If you forget your password, you can change it by accessing the

login page. There, you can click on the “forgot password” link.

Check this guide to see how to

change your password if you forget it.

What do I do if I

forget my pin?

Your pin is a code that you use for money transfers and payouts

on Fapshi; when you create an account, you'd see the option to

create this code. If for some reason you lose your code, you'd

have to submit a

support ticket.